While Macau’s operators have reached nine consecutive quarters of substantial GGR losses, the rest of Asia is opening up and learning to live with COVID-19. We take a look at where each of the major gaming jurisdictions stands as of June 2022.

“We’re back!” They are the words the world has been waiting to hear and that our industry has been desperately craving.

“We’re back!” They are the words the world has been waiting to hear and that our industry has been desperately craving.

More than two years since the global outbreak of COVID-19 saw borders slammed shut, communities placed into lockdown and casino doors shuttered – often for the first time since their launch – Asia is finally reopening. And at some pace too.

Despite suffering an unexpected setback to start the year, as the Omicron variant swept from shore to shore, at the time of writing almost all of the 48 nations considered by the United Nations to comprise Asia-Pacific had either fully or partially reopened their borders to international tourism, or are planning to do so in the coming weeks.

Despite suffering an unexpected setback to start the year, as the Omicron variant swept from shore to shore, at the time of writing almost all of the 48 nations considered by the United Nations to comprise Asia-Pacific had either fully or partially reopened their borders to international tourism, or are planning to do so in the coming weeks.

The notable holdout is China, which continues to stick solid with its “dynamic zero-COVID” policy, highlighted by strict lockdowns in areas where new cases are detected. Despite reports of rising tensions between residents and officials in Shanghai – where more than two months of restrictions have led to food shortages and limited access to health care – President Xi Jinping told a meeting of the Politburo Standing Committee (PBSC) in early May that China must “unswervingly adhere to the general policy of dynamic zero-COVID.”

Officials, Xi added, must “resolutely implement the decisions of the [Party], fully carry forward the fighting spirit and resolutely build a barrier for epidemic prevention and control.

“We have won the battle to defend Wuhan, and we will certainly be able to win the battle to defend Shanghai.”

China’s determination to push forward with its zero-COVID strategy has, naturally, carried over into its Special Administrative Region of Macau, where Health Director Alvis Lo Iek Long recently confirmed the city will “maintain an identical policy with mainland China” – suggesting any opening of international borders will not be contemplated any time soon.

This, in theory, should not be of particular concern to Macau’s gaming and tourism operators, given that 70.9% of all visitor arrivals in 2019 came from mainland China, with another 18.7% from Hong Kong. But with the borders between Macau, Hong Kong and the mainland also subject to varying levels of restrictions depending on the prevailing COVID situation at the time, visitation continues to be stifled and operators continue to notch up heavy losses.

This, in theory, should not be of particular concern to Macau’s gaming and tourism operators, given that 70.9% of all visitor arrivals in 2019 came from mainland China, with another 18.7% from Hong Kong. But with the borders between Macau, Hong Kong and the mainland also subject to varying levels of restrictions depending on the prevailing COVID situation at the time, visitation continues to be stifled and operators continue to notch up heavy losses.

According to a March note by Morgan Stanley, Macau’s concessionaires are losing a combined US$800 million and leaking US$250 million in cash flow per quarter while COVID-19 restrictions remain in place, and industry net debt has risen from around US$5 billion pre-COVID to US$20 billion at end-2021 – all with no end in sight.

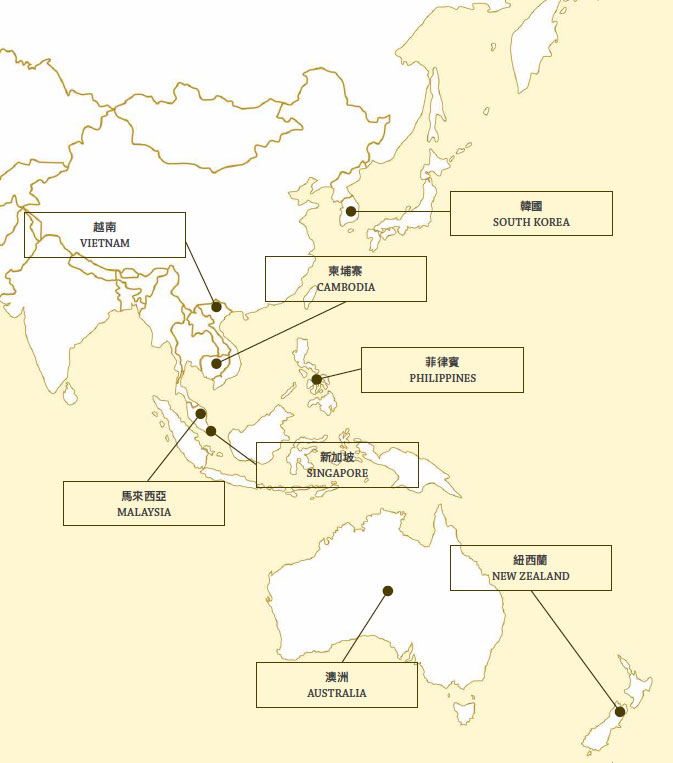

Meanwhile, the rest of Asia is getting on with life and the early signs across the region’s key gaming jurisdictions are broadly positive. IAG takes a closer look at how these jurisdictions are positioned for recovery in 2022.

PHILIPPINES

The Philippines was among the countries hit hardest by COVID-19, with Delta resulting in a daily peak of 26,251 cases in September, surging to more than 38,000 in mid-January following the arrival of Omicron.

But recovery has been swift – so much so that the government reopened its borders to fully-vaccinated international tourists in February. It also eased capacity restrictions in Metro Manila in March and dropped all lockdowns nationwide in April – the first time in more than two years the country had been lockdown-free.

While industry recovery has been largely driven by the Philippines’ strong domestic market – international business is expected to take longer – the early signs are good: Manila’s market leading Solaire Resort & Casino reported gross gaming revenues of Php8.9 billion (US$170 million) in 1Q22 – up 30% year-on-year and 12% higher than the December 2021 quarter.

Its local rival, Okada Manila, felt the impact of headwinds facing the regional VIP industry, with VIP revenue down 33% quarter-on-quarter, but mass and slot revenue grew by 7% to reach 76% of pre-COVID levels.

More importantly, investment bank Morgan Stanley wrote in an April note that it expects Philippines industry GGR to reach 85% of 2019 levels by the end of the year, and possibly higher, “enabled by ASEAN travel reopening in 2Q22 and eased COVID control measures as of March 2022.”

Light & Wonder’s Vice President and Managing Director for Asia, Ken Jolly, told IAG the Philippines is clearly the fastest recovering market in Asia, with definite signs that casino floors are getting busier and passenger volume at airports in Manila and Clark increasing.

“The Philippines is by far the strongest market in terms of ramp at the moment,” Jolly said.

SINGAPORE

Much like the Philippines, Singapore has wasted no time in reopening its borders and pushing for life to return to normal. In fact, the sovereign state was the first major Asian jurisdiction to welcome back international tourists when it launched a Vaccinated Travel Lane Scheme last October for arrivals from around a dozen nations. Border restrictions for vaccinated travellers have now been removed altogether – since 26 April tourists no longer even need a negative COVID-19 test prior to departure. Restrictions on group sizes in public venues have also been dropped.

Both IR operators – Las Vegas Sands and Genting Singapore – printed sequential improvements in 1Q22 but expect the recovery trajectory to accelerate over the coming months with LVS Chairman and CEO Rob Goldstein predicting Marina Bay Sands would soar back over US$1 billion in EBITDA in 2022.

“I think Singapore is back and will experience the same post-COVID numbers as the US in my opinion,” he said during the company’s 1Q22 earnings call. “The demand is there and will continue, assuming no more surprises from the pandemic.”

Suppliers IAG spoke with said the two Singaporean IRs were already looking at refreshing their floors with new hardware this year – other jurisdictions are taking a wait-and-see approach – and have resumed significant player promotions.

“That’s a strong sign that the market is back,” says IGT’s Sales Director, Asia, Michael Cheers.

MALAYSIA

Malaysia was another country to have faced extended lockdowns, or Movement Control Orders (MCOs) as they were called, over the past 12 months, with the Delta variant seeing daily cases reach around 25,000 in September before Omicron lifted that to a peak of 33,406 in March.

However, the last of Malaysia’s MCOs was lifted for vaccinated individuals in October 2021 with a view to kickstarting the economy. First steps towards the reopening of international borders took place in November when its land border with Singapore was partially opened, followed by air routes between the two in January. In late March, Malaysia dropped all quarantine requirements for international visitors with only a negative COVID-19 test result required for the unvaccinated.

While the nation’s sole integrated resort, Resorts World Genting, reopened to Genting Rewards Members only on 30 September 2021, its three gaming floors – SkyCasino, Genting Club and Genting Casino – are now open 24 hours and operating at full capacity.

Maybank IB Research analyst Samuel Yin Shao Yang said in a recent note that RWS is benefiting from the reopening of its borders, particularly with Singapore, writing, “many Singaporean mass market gamblers are heading to RWG to gamble rather than the other way around, due to the strong SGD and casino entry levy in Singapore.”

Suppliers note that RWG is gradually returning to pre-COVID levels but expect business to ramp significantly towards the back end of 2022.

Suppliers note that RWG is gradually returning to pre-COVID levels but expect business to ramp significantly towards the back end of 2022.

SOUTH KOREA

South Korea’s casino industry has been well and truly battered by the COVID-19 pandemic – not surprising when you consider that 16 of the nation’s 17 casinos are restricted to foreigners only. The two largest foreigner-only casino operators, Paradise Co and Grand Korea Leisure, have suffered significant losses, with Paradise reporting net losses of KRW48.74 billion (US$38.6 million) and KRW25.22 billion (US$20.0 million) in 2020 and 2021 respectively, while GKL recorded a loss of KRW113.27 billion (US$94.4 million) in 2021, having previously lost KRW64.3 billion (US$57.9 million) in 2020. South Korea has also experienced some lag in its COVID-19 recovery – officials said the Omicron outbreak peaked only in late March – however moves are now well underway to have the country catch up to its regional peers who are rapidly opening up to the world. Almost all social distancing rules, with the exception of mask wearing, were dropped for the first time in more than two years on 18 April, with capacity limits for both public and private venues removed. That same month it also removed a mandatory seven-day quarantine requirement for fully-vaccinated travellers, although a negative COVID-19 test is still required for entry.

There has also been positive news for the holiday island of Jeju – home to eight of Korea’s foreigner-only casinos – with the announcement that visa-free travel for fully-vaccinated travelers from most countries would resume from 1 June. Those countries include Jeju’s main feeder market of China, although recent revelations that Beijing is actively restricting non-essential outbound travel of Chinese citizens, particularly to destinations offering casino gaming, may dampen those prospects.

There has also been positive news for the holiday island of Jeju – home to eight of Korea’s foreigner-only casinos – with the announcement that visa-free travel for fully-vaccinated travelers from most countries would resume from 1 June. Those countries include Jeju’s main feeder market of China, although recent revelations that Beijing is actively restricting non-essential outbound travel of Chinese citizens, particularly to destinations offering casino gaming, may dampen those prospects.

Industry experts do not expect recovery for South Korea’s casino industry to be as fast as elsewhere, however operators have resumed marketing to foreign customers and it has been reported that flights between Korea and Japan will soon return to pre-COVID volumes after dipping to less than 10% of normal levels.

As for Kangwon Land, the only casino in South Korea where locals are permitted to gamble, recovery is expected to accelerate after normal operating hours were restored in April and full capacity resumed from 16 May. The property had previously been limited to 50% capacity. Kangwon Land slashed its net loss in half, to KRW5.85 billion (US$4.6 million) in the three months to 31 March but analysts expect a return to profit in Q2.

VIETNAM

Recognizing the importance of its tourism industry, which contributed around 18.5% of Gross Domestic Product in 2019, Vietnam was among the first to trial a vaccinated passport scheme in 2021, even while COVID-19 case numbers soared nationwide. Initially open to five cities and provinces, Vietnam welcomed its first arrivals under the scheme to Quang Nam in November with around 430 international guests staying at Suncity’s Hoiana, followed by another 200 from South Korea soon after.

Air borders opened more significantly from 1 January with arrivals from nine selected nations allowed, while in March authorities resumed visa free entry for arrivals from 13 countries.

Most restrictions for fully-vaccinated travelers, including a previous seven-day hotel quarantine rule and COVID-19 test on arrival, were dumped in April and a requirement to obtain a negative test result within 72 hours of departure from their location removed from 15 May – a clear sign that Vietnam is now opening to the world.

That’s good news for a nation that, like South Korea, operates primarily on a foreigner-only casino model, although the jury is still out on whether Vietnam will ever be considered a first-choice casino destination – despite the presence of high-quality, multi-billion-dollar destinations such as Hoiana and The Grand Ho Tram Strip.

More appealing is the possible expansion of a locals pilot program, with Vietnam’s Ministry of Finance pushing to extend the program until 2024 and add in two more casinos located in Da Nang City and Khanh Hoa Province.

At present, only one operational casino – Corona Resort & Casino in Phu Quoc – is permitted to welcome locals under the scheme.

A representative of industry supplier Aristocrat told IAG, “Since … Vietnam has fully reopened its borders we have seen tourism and our customers’ businesses recovering healthily. Like other countries in Asia there are still reduced flight schedules, so once they return fully we anticipate that business will return to healthy levels.”

CAMBODIA

Cambodia welcomed a record 6.61 million international tourists in 2019, bringing in US$5.3 billion in spending comprising almost 20% of the US$27.1 billion Gross National Product, but arrivals fell to 1.31 million in 2020 and to just 196,495 in 2021, with spend of US$184 million. No wonder reopening has been seen as a national priority.

In March, Prime Minister Hun Sen announced the immediate removal of almost all remaining COVID-19 travel restrictions for fully vaccinated international visitors including a previous requirement to obtain a negative virus test within 72 hours of departure and another upon arrival. Cambodia also resumed the issuance of visas on arrival for people entering by land, air and sea.

In March, Prime Minister Hun Sen announced the immediate removal of almost all remaining COVID-19 travel restrictions for fully vaccinated international visitors including a previous requirement to obtain a negative virus test within 72 hours of departure and another upon arrival. Cambodia also resumed the issuance of visas on arrival for people entering by land, air and sea.

“Now is the time to open up the economy by learning to live with COVID,” he said.

That’s good news for Cambodia’s only true integrated resort, NagaWorld in Phnom Penh, which saw average daily net gaming revenue across all segments grow 34% sequentially in 1Q22 to US$1.08 million, up from US$808,000 in 4Q21.

It does appear that the road back for the nation’s many border casinos in towns such as Poipet and Bavet may be longer, with most yet to receive government approval to reopen. In May, the deputy director-general at the Finance Ministry’s Financial Industry Department, Ros Phearun, said, “I have noticed that some owners wish to resume their business operations, but it is still impossible because [their] facilities were closed down for a long time. They also need to hire people for work.”

Operators of some border casinos also noted the difficulties they were having in bringing back staff, however there is room for optimism, with Thailand having given the green light to reopen its land border with Cambodia from 1 May and Vietnam doing the same for its border with Cambodia on 13 May.

More broadly, Cambodia’s tourist numbers in 1Q22 reached 159,546, representing a 125% improvement over the same period in 2021 and 148% higher than the December 2021 quarter.

“Traffic has seen a noticeable uplift from April, as Malaysia and Singapore reopened travel to the country,” said an Aristocrat representative.

“Traffic has seen a noticeable uplift from April, as Malaysia and Singapore reopened travel to the country,” said an Aristocrat representative.

“Cambodia’s gaming industry has traditionally been quite reliant on the Chinese consumer and therefore, until they return, we expect both GGR and foot traffic to be lighter than pre-COVID.”

AUSTRALIA AND NEW ZEALAND

Australia and New Zealand were renowned for having some of the tightest COVID-19 restrictions in the world throughout the pandemic, with their borders not only closed to all international tourism but also to a large number of local citizens trying to return home from overseas. Melbourne, Australia’s second most populous city behind Sydney, even earned the moniker of being the most locked down city in the world – its citizens subjected to 262 days of restrictions across six separate lockdowns between March 2020 and October 2021.

But the move to end restrictions was rapid. In November 2021, Australia began its road to recovery by allowing – for the first time in 18 months – fully-vaccinated Australian citizens and residents to travel internationally and quarantine at home upon their return. Then, in February 2022, it reopened borders to fully vaccinated tourists with the government declaring it needed to give certainty to the tourism industry.

“In 2018-19, tourism generated more than AU$60 billion for the Australian economy, with more than 660,000 jobs dependent on the industry,” it said.

New Zealand has been more circumspect, opening its borders to Australians only in April, then to nations subject to New Zealand’s visa-waiver program, including the United States, United Kingdom, Singapore, Japan, South Korea and most of Europe, from 1 May. A full reopening to the rest of the world is expected to take place from 31 July.

Despite this, the game has already changed for casino operators across the two countries, with Crown Resorts, Star Entertainment Group and SkyCity Entertainment Group having all ended junket relationships and scaled back their international VIP business segments in response to recent inquiries into both Crown and Star. They also face renewed scrutiny on international money transfers in the future under new laws being introduced in some states and following recent revelations by Australia’s financial crimes watchdog AUSTRAC that it is investigating the three operators. AUSTRAC has already launched civil proceedings against Crown for alleged contraventions of obligations under the Anti-Money Laundering and Counter-Terrorism Financing Act.

Weighing in the operators’ favor, now that almost all social distancing measures have been dropped, is Australia’s strong domestic market. Domestic gaming comprised 75% of Crown’s GGR in 2019 and 77% of Star’s, with the segment set to become increasingly important now that life is returning to normal.

“We can see from an APAC perspective that there has been a normalization in terms of Australia and New Zealand,” says IGT’s Michael Cheers. “It’s probably Australia first and New Zealand second – New Zealand is a little bit slower in coming back – but the Australian market is definitely looking positive and we expect it will continue to build momentum towards the end of this year and into 2023.”

“We can see from an APAC perspective that there has been a normalization in terms of Australia and New Zealand,” says IGT’s Michael Cheers. “It’s probably Australia first and New Zealand second – New Zealand is a little bit slower in coming back – but the Australian market is definitely looking positive and we expect it will continue to build momentum towards the end of this year and into 2023.”

The post We’re Back! appeared first on IAG.

Read Rhis 👉 新聞來源

——

博彩新聞 Gambling Inside News

https://t.me/GamblingInsideNews

——

via Adam Qain AceBqj7s

#香港 #HKG 🇭🇰

#IAG

#亞博匯

留言

張貼留言